A radical new way of making payments has been taking the world by storm since 2009. The creation of Bitcoin quickly brought cryptocurrency into the spotlight, showcasing digital currencies and a revolutionized financial system – one with a decentralized peer-to-peer payment system. Cryptocurrency growth doesn’t seem to be slowing down anytime soon, and the rising popularity of cryptocurrencies in developing countries is hard to ignore.

In short, a Cryptocurrency is a decentralized digital currency secured by cryptography. Cryptocurrencies don’t have a central issuing or regulating authority, instead they use a decentralized system based on blockchain technology to record transactions and issue new units.

There are thousands of different cryptocurrencies, each with unique functions and specifications. However, the most popular blockchain-based cryptocurrency is still the first, Bitcoin, with there being an estimated 106 million Bitcoin owners and 200 million Bitcoin wallets in 2022.

Cryptocurrencies attracted the attention of the public – nothing like it had ever been seen before and it promised to solve the inefficiencies that came with traditional financial systems surrounding it with conversation and debate.

The rising popularity of cryptocurrencies in developing countries

Developing countries are some of the largest users of cryptocurrencies due to its popularity in the remittance market. The World Bank estimates that remittances – the money that migrants send back to family or friends in their countries of origin – can account for up to 20% and even as high as 40% of Gross Domestic Product (GDP) in many developing countries.

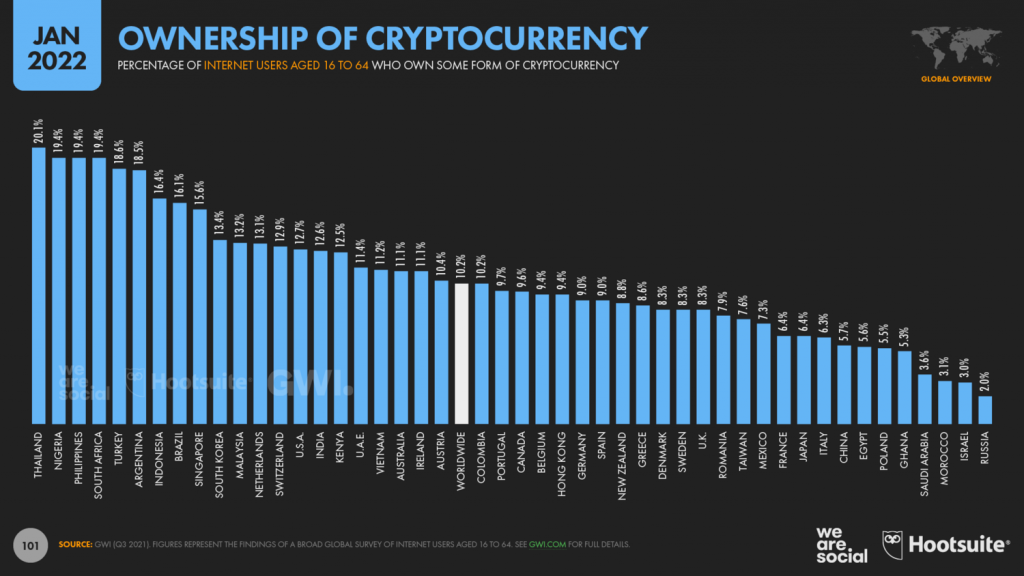

According to the Digital 2022 Global Overview Report – published by DataReportal in partnership with We Are Social and Hootsuite, more than 1 in 10 working-age internet users now owns some form of cryptocurrency. With this number being higher across developing economies, especially in countries where conventional currencies are more prone to fluctuations in exchange rates.

(Graph 1: Ownership of Cryptocurrency by country)

Cryptocurrency is gaining so much traction in developing countries that some are announcing the decision to make cryptocurrencies, such as Bitcoin, an official currency. These countries are typically those whose economy relies heavily on the remittance market. El Salvador for example passed a law in June of 2021 to recognize Bitcoin as legal tender in the country, giving it equal status as the US Dollar, which was the primary currency used up to that point. The country’s economy is heavily dependent on the remittance market, and it accounts for over 20% of their GDP, with 95% of the remittances being from Salvadorans working in the United States going to their families still in El Salvador. These remittances are essential to the economic health of El Salvador and many other developing countries, and cryptocurrencies are becoming a popular method of the remittance market.

In more stable economies, cryptocurrencies are often viewed with a veil of suspicion, with many not trusting the digital management of the coins and viewing the currencies as having a strong reputation of use. These concerns are further compounded by regulators in the US and Europe issuing warnings over trading crypto furthering its unreliable reputation. However, in developing countries, with histories of financial instability and difficulty accessing traditional financial tools, cryptocurrencies are becoming an everyday normality.

The rising popularity of Cryptocurrencies in developing countries can be attributed to the unique opportunities it offers towards expanding people’s economic freedom around the world. These opportunities come from three main characteristics of cryptocurrencies; its accessibility, the low transaction costs and speeds, and finally its ability to counter weak national currencies and corruption.

Accessibility

The use of cryptocurrency is proving to be a valuable tool for developing countries to solve issues associated with the lack of accessibility to traditional financial systems. The use of cryptocurrency is proving to be a valuable tool for developing countries to solve issues associated with the lack of accessibility to traditional financial systems. As many developing countries rely on the remittance market, the lack of accessibility to traditional financial tools, such as banks, can have serious negative impacts on developing economies.

Cryptocurrency, unlike the traditional financial market, does not need a physical infrastructure, it is readily available through internet access. As such, cryptocurrency serves to bank those that are unbanked. In developing countries, access to banking infrastructure has been hindered by a lack of physical infrastructure as well as high fees, especially for mobile banking, which complicates access to traditional bank accounts. As a result, many are excluded from traditional financial services and have no means of receiving payments from abroad, which limits their participation in e-commerce.

Consequently, individuals in developing countries with limited access to traditional banking infrastructure can access the financial services needed with cryptocurrencies via the internet, without establishing a bank account or using physical banking facilities.

Low transaction costs and times

The cost and time involved in transferring funds through traditional financial systems can be prohibitive for both the sender and the receiver. As many developed countries are dependent on the remittance market, these costs and delays are often seen as a disadvantage to traditional financial systems and cryptocurrencies are seen as a solution.

Cryptocurrencies are a viable alternative to the traditional means of receiving remittances, and it enables quick and low-cost international money transfers. They are decentralized networks, essentially cutting out the middleman. This makes international fund transfers quicker than traditional ones as users can transfer money without dealing with an intermediary authority. In contrast to traditional funds transfers, which often take days to process and approve, cryptocurrency transfers are typically completed in minutes, requiring only the block with your transaction to be confirmed by the network before being fully settled and the funds available..

Since traditional methods of transferring funds also typically come with high fees, it is more common for remittances to be less frequent in larger amounts, as this provides the most value with the least fees. Using cryptocurrency can significantly reduce these fees, thereby expanding international finance options. The individuals that are sending remittances back to family or friends in their home countries are able to send lower amounts of money more frequently, as they do not have to account for transaction fees.

Countering weak national currencies and corruption

Cryptocurrencies are increasingly used in developing countries where the local currency is experiencing hyperinflation, corruption is rampant, and there is a long history of financial hardship. Traditionally, these issues arise as a consequence of the financial system, and cryptocurrencies are often viewed as an alternative that can assist in overcoming them.

Developing countries have faced decades of restricted banking policies and deteriorating infrastructure as a result of traditional financial systems, with unpredictable inflation and volatile exchange rates continuously weakening their fiat currency’s value. This has made cryptocurrencies a strong alternative to weak national currencies. They are not regulated by governments or banks due to their decentralized nature, so access cannot be restricted, and their operation cannot be altered. They are also not subject to the same market fluctuations as fiat currencies.

Furthermore, citizens in developing countries often perceive fiat currencies as unreliable and untrustworthy. The blockchains behind cryptocurrencies have created better trust with users through their ability to fight corruption, as it is based on a distributed digital ledger where every transaction is recorded and cannot be modified. Transactions are recorded and cannot be reversed, which highly reduces the likelihood of being defrauded. This also reduces the possibility of manipulating transactions.

Consequences of this?

The reasons behind the rising popularity of cryptocurrencies in developing countries seem to show it as a solution for the many problems developing countries often face with the traditional financial market. Despite its rapid growth and increasing use, cryptocurrency still has some serious disadvantages, and the consequences of its use should be considered.

While there are a growing number of companies that accept cryptocurrencies, it is not widely accepted or internationally recognized. This severely limits the places that users can spend their money, something that is not an issue with traditional methods of payment from recognized financial institutions. Cryptocurrencies are not globally recognized as legal tender, with 80% of the world’s central banks being either not allowed to issue digital currency under their existing laws or having legal frameworks that are ambiguous and do not clearly allow its use.

There is also the problem of cryptocurrencies having a limited supply. Bitcoin for example, has a maximum supply of 21 million bitcoins to mine, meaning they have a finite supply, and the price is the only variable that can change to ensure demand. This also means that cryptocurrencies do not store value, as they are not liquid, nor universally accepted and do not have a stable value. This makes cryptocurrency very volatile, since its growth rate is unpredictable and cannot be controlled.

Cryptocurrencies are growing in popularity in developing countries, and they are being adopted as official currencies by governments, but they face strong opposition from the traditional global financial system. In response to the rise of cryptocurrency being adopted as currency, officials from both the International Monetary Fund (IMF) and the World Bank have expressed concerns regarding the consequences of its use. Officials argue that by adopting cryptocurrency, nations could undermine capital controls, while simultaneously exposing their citizens to severe price volatility.

The World Bank has taken stronger stances in its opposition following El Salvador’s decision to make bitcoin legal tender and stated that it would not work with the country on its cryptocurrency plans due to the volatile nature of cryptocurrency assets. The IMF has also been a vocal critic of adopting cryptocurrencies as an official currency, stating that it is unsuitable as a national currency due to the possibility of a sudden drop in the price of Bitcoin.

The future of cryptocurrencies in developing countries?

The debate over cryptocurrency as a currency is not likely to end anytime soon. Cryptocurrency continues to gain popularity in developing nations over traditional financial institutions. It is speculated by cryptocurrency supporters that traditional global financial system stewards are less concerned with the protection of the developing world and are more concerned with preserving the system that allows central banks and governments of rich countries to control the global monetary system.

Although the IMF opposes cryptocurrency adoption as a currency, it has recognized its benefits and encouraged its use – just not as a legal tender. They have instead encouraged national central banks to utilize the blockchain technology behind cryptocurrency for digital upgrades to their own sovereign currency. By using this approach, developing countries could benefit from the same advantages that have made cryptocurrency so popular while avoiding the risks of a volatile currency.

It’s still unclear what the future holds for cryptocurrencies in developing countries. Many supporters of the technology see limitless potential and solutions to problems that have plagued developing countries for decades, while critics see only its risks. As more developing countries adopt cryptocurrency, the traditional global financial system is likely to work to integrate the benefits of the technology into their own, while still opposing its use as an official currency.