Foreign Direct Investment (FDI) is a crucial driver of economic growth and development in any country. When it comes to attracting FDI, the United States stands as one of the most desirable destinations for investors worldwide. One of the key factors that make the US an attractive investment hub is its commitment to the rule of law and the robust protection of intellectual property (IP) rights.

In this article, we will delve into the significance of the rule of law and IP rights protection in attracting FDI to the US.

- Explore more articles in this series:

- Why The US Leads The World In Entrepreneurship And Innovation

- Understanding the US Consumer Market: Key Trends and Insights

- Why Expanding Your Business into the USA is a Smart Move: A Comprehensive Guide

- Ease Of Doing Business In The U.S.: A Major Draw For Foreign Investor

- Tips And Strategies For Successfully Investing In The United States: Part 2

- Tips And Strategies For Successfully Investing In The United States: Part 1

The Rule of Law and its Relevance to FDI

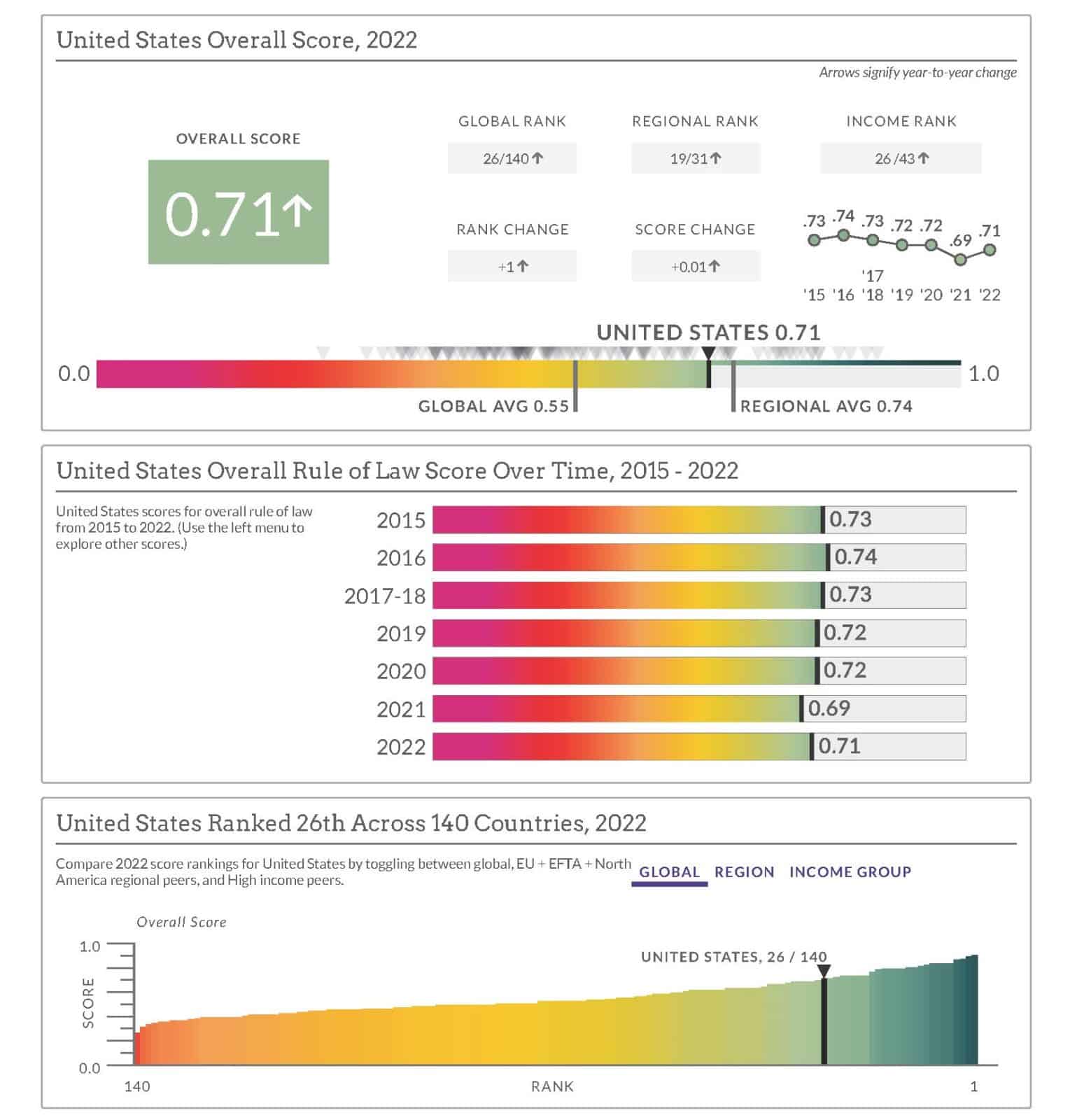

The rule of law is a fundamental principle that ensures the fair and consistent application of laws within a society. Effective rule of law reduces corruption, combats poverty and disease, and protects people from injustices. Moreover, it provides predictability, stability, and transparency in legal systems, which are crucial for attracting foreign investors. When investors have confidence in the legal framework of a country, they feel secure in their investments and are more willing to commit capital for long-term ventures.

The United States boasts a strong and well-established legal system that upholds the rule of law, ensuring property rights, contract enforcement, and the resolution of disputes through an impartial judicial system.

Intellectual Property Rights (IPR) and FDI

Intellectual Property Rights encompass a range of legal protections that grant exclusive rights to creators and innovators over their inventions, designs, trademarks, and creative works. Strong and effective IP protection is essential for attracting FDI, especially in industries driven by innovation and technology. Investors seek assurance that their intellectual assets will be safeguarded, allowing them to reap the benefits of their innovations and maintain a competitive edge in the market. Countries with robust IPR frameworks tend to attract more FDI, particularly in industries that rely heavily on intellectual assets.

The Role of IP Rights Protection in FDI Attraction

Robust IP rights protection serves as a critical incentive for foreign investors. It encourages innovation, fosters creativity, and attracts businesses involved heavily in research and development, such as pharmaceuticals, biotechnology, software development, and high-tech manufacturing. By protecting IP, a country demonstrates its commitment to rewarding and nurturing innovation, creating an environment that appeals to foreign investors seeking to protect their inventions, trademarks, copyrights, and trade secrets.

The US has robust IP laws and enforcement mechanisms that protect patents, trademarks, copyrights, and trade secrets. This strong protection incentivizes foreign companies to invest in the US, knowing that their valuable IP will be safeguarded.

The US Legal System and FDI

The United States boasts a well-developed legal system built on the principles of the rule of law. Its judiciary is independent and provides impartial adjudication of disputes, ensuring a fair and transparent business environment. The US legal framework protects property rights, enforces contracts, and provides a comprehensive system for IP rights registration and enforcement. Investors need assurance that their investments will be secure and that they can rely on legal remedies in case of disputes.

The US legal system offers protection for both domestic and foreign investors, with courts that enforce contracts and resolve investment-related conflicts fairly. These factors make the US an attractive destination for FDI.

Transparency, Predictability, and Dispute Resolution Mechanisms

Transparency and predictability are essential for investors when making long-term investment decisions. The US legal system ensures transparency through public access to laws, regulations, and court proceedings. This transparency allows investors to understand the legal framework and make informed choices. Additionally, predictable legal outcomes provide confidence to investors, reducing investment risks. Furthermore, The US regulatory system provides a clear framework for businesses to operate, ensuring that regulations are consistent, fair, and proportionate. A predictable regulatory environment reduces uncertainty for investors and facilitates their long-term planning and investment strategies.

In addition, international investors seek jurisdictions with efficient and impartial dispute-resolution mechanisms. In the US, both domestic and foreign investors can access a range of avenues for resolving disputes, including arbitration, mediation, and the US court system. These mechanisms provide investors with legal recourse and ensure a fair and timely resolution of conflicts.

The United States has signed 45 bilateral investment treaties (BITs) with different countries. These agreements are specifically designed to promote investment by offering legal protections and guarantees to foreign investors. The main goal of BITs is to establish a stable and predictable environment for investment, benefiting both the host country and the foreign investor. These agreements include various provisions, such as ensuring equal treatment for all investors, treating them fairly and reasonably, and protecting against unfair seizure of investments without appropriate compensation. Moreover, these agreements also provide mechanisms for resolving investment disputes through a process called investor-state dispute settlement.

Property Rights and Contract Enforcement

Respecting property rights is vital for attracting FDI. The US has well-established property rights laws that protect both tangible and intangible assets. This includes real estate, intellectual property, and contractual rights. Foreign investors can rely on the US legal system to enforce their property rights and contractual obligations, fostering a secure environment for investment.

Corruption and Bribery

The absence of corruption and bribery is crucial for attracting FDI. The US has implemented robust anti-corruption measures, such as the Foreign Corrupt Practices Act (FCPA), which prohibits US companies from engaging in corrupt practices abroad. This commitment to integrity and ethical business conduct enhances the trustworthiness of the US market, making it an attractive destination for foreign investors.

Labor Laws and Social Stability

Labor laws and social stability are crucial factors that influence investment decisions. The US maintains a robust labor law framework that protects workers’ rights while providing flexibility for businesses. Additionally, the country’s social stability, characterized by political stability, respect for human rights, and social cohesion, creates an environment conducive to investment.

Strengthening the Rule of Law and IP Rights Protection

To further enhance its attractiveness to foreign investors, the US must continue strengthening the rule of law and IP rights protection. Regular evaluation and improvement of IP laws and regulations, keeping pace with technological advancements, and addressing challenges in enforcement are necessary steps. By providing a legal environment that promotes innovation, the US can continue to attract FDI and bolster its economic growth.

Conclusion

Foreign Direct Investment, the rule of law, and robust IP rights protection are interconnected and vital for attracting FDI to the US. The US legal system’s stability, transparency, and protection of intellectual property assets instill confidence in foreign investors. By upholding the rule of law and continually improving IP rights protection, the US can maintain its position as a top destination for FDI, driving economic growth and fostering innovation.