In the ever-evolving realm of global trade, shifts and transformations are not uncommon. One such significant shift occurred recently when Mexico emerged as a prominent player in the trade arena, surpassing China as a major contributor to US imports. This pivotal change has far-reaching implications and paints an intriguing picture of Mexico’s role in the world of international commerce. In this comprehensive blog post, we delve deep into the dynamics of this shift, exploring the underlying factors, challenges, and opportunities that have shaped Mexico’s ascent as a trade giant.

The Trade War Prelude: How It All Began

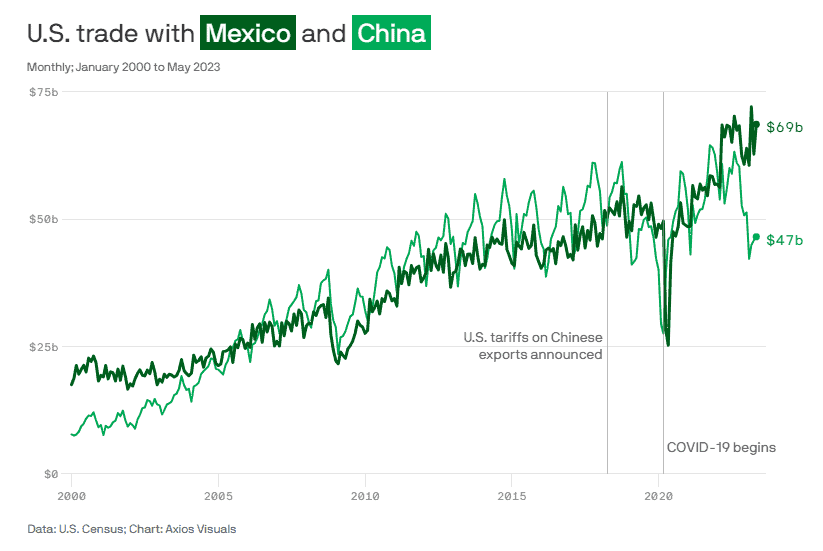

The story begins in 2018 when the United States initiated a series of tariffs on China and other trade partners as part of the “America First” economic policy championed by the Trump administration. The primary objective was to reduce the US trade deficit by transitioning from multilateral free trade agreements to bilateral deals. These tariffs marked the inception of the US-China Trade War, significantly increasing the cost of Chinese goods for American consumers. Consequently, consumers began exploring alternatives from non-tariff countries, making goods from Mexico appear more attractive.

Mexico’s Appeal: A Perfect Storm

For American manufacturers, the appeal of relocating production to Mexico became evident. Mexico offered a skilled workforce, robust transportation infrastructure, a sprawling border shared with the US, a well-established export industry, and favorable trade access. This combination of factors presented Mexico with an unprecedented opportunity, potentially surpassing the benefits reaped from the North American Free Trade Agreement (NAFTA) signed in 1994.

However, Mexico’s journey wasn’t without obstacles. Between 2018 and 2021, while the proportion of manufactured goods imported from Mexico to the US saw modest growth, low-cost Asian competitors such as Vietnam, Indonesia, and the Philipines emerged as significant winners in the global trade arena. Other Asian countries, excluding China, increased their share of US manufactured goods imports from 12.6% to 17.4% during this period.

Biden Administration’s Role: Expanding the Trade War

Upon taking office, the Biden administration retained most of the tariffs introduced by its predecessor while introducing new trade policies. This expansion aimed to reduce China’s presence in US supply chains, particularly in high-tech industries, through export controls and investment restrictions.

The outbreak of the pandemic in 2020, followed by Russia’s invasion of Ukraine, disrupted global supply chains. China’s alignment with Russia intensified efforts by the US and its allies to diversify their sources of goods, reducing their dependence on China. The complexity of global trade created an immense business opportunity, with Mexico positioned favorably to capitalize on these changes.

The Two Options: Fortifying or Nearshoring

In the face of supply chain disruptions, businesses found themselves at a crossroads. They could strengthen their global supply chains by building redundancy and increasing inventory, albeit at a higher cost. Alternatively, they could reduce political and geographical risks by nearshoring—moving production closer to the market.

Mexico’s proximity, abundant resources, young and productive workforce, and favorable location allowed it to overtake China as the United States’ leading goods supplier. Alongside its growing exports, Mexico experienced a strengthening currency and a robust stock market, with foreign direct investment surging by over 40% in 2023.

Despite its newfound prominence, Mexico faces challenges associated with corruption, ease of doing business, and infrastructure deficiencies. China, with its world-class infrastructure and massive manufacturing capabilities, remains a formidable competitor.

The Role of Nearshoring: A Slow but Steady Transition

While companies like Apple diversify their manufacturing locations beyond China, Mexico is not yet capable of matching China’s scale. The indirect subsidy of China’s transportation and logistics infrastructure presents a significant challenge for Mexico.

Nuevo León: A Beacon of Hope

The Mexican state of Nuevo León, led by Governor Samuel García, has actively courted foreign investment and improved transportation infrastructure to facilitate the movement of goods to border crossings. The World Trade International Bridge connecting Texas and Nuevo León plays a pivotal role in this endeavor.

Major companies like Lego, Mattel, Unilever, and even Chinese companies like Hofusan are making significant investments in Nuevo Leó . BMW’s announcement of a substantial investment in Mexico to produce battery packs for electric cars exemplifies the growing interest in the country.

Complex Trade Relationships: Unveiling the Truth

While at first glance, it may appear as if U.S.-China trade ties have weakened, the reality is slightly more nuanced. Several elements, such as transshipment, blur the trade scene. Transshipment involves the re-labeling of Chinese goods to create an impression that their country of origin is another nation.

A case in point is an incident that took place earlier this year when the Department of Commerce discovered that a significant percentage of imported solar panels from Southeast Asia contained predominantly Chinese components.

Moreover, the intricate nature of value chains complicates this picture further. The significant reduction in worldwide transportation costs has led to the expansion of value chains, often spanning across dozens of countries. Today, the lion’s share of international trade is primarily composed of intermediate goods as opposed to entirely finished products. A sizable proportion of goods that the U.S. imports from Mexico are composed of parts that originated in China.

As such, these obscured factors suggest that the trade relationship between the U.S. and China remains robust, despite outward appearances.

Reality of Nearshoring Trends in Mexico

Mexico’s status as a nearshoring destination is not without challenges. Water shortages, particularly along the US-Mexico border, pose a significant concern. Furthermore, electricity shortages impact crucial industries like manufacturing. Two years ago, Taiwan based Quanta Computer, opened a manufacturing plant in North Mexico, primarily to construct computers for Tesla vehicles. However, the factory’s productivity was frequently compromised due to consistent electrical blackouts. This challenge was attributable to the electrical grid’s struggles to accommodate the rapid growth of industries in the region.

The AMLO Factor: Government’s Role

The government of President Andrés Manuel López Obrador, often referred to as AMLO, has received criticism for its impact on Mexico’s economic performance. His policies, perceived as anti-business, have deterred investment. The government under him has frequently sparred with business stakeholders in its pursuit to enhance the state’s role in the economy. His administration has strived to limit foreign companies’ influence in Mexico’s energy markets and even moved to seize control of a privately-run railway line earlier this year, before eventually reaching a settlement with its owner.

AMLO ascended to power in 2018, endorsing a left-leaning, nationalistic agenda. He aspires to rejuvenate Mexico’s economy to reflect the oil-powered, state-controlled dynamics of the 1970s. Moreover, he seeks to establish a “moral economy” that prioritizes impoverished communities.

However, his routine practice of criticizing multinational companies during daily press briefings does little to inspire confidence in foreign businesses evaluating investment opportunities in Mexico.

AMLO’s insistence on enforcing “republican austerity” — demonstrated by his personal pay cut and economical travel habits — led to salary reductions for high-ranking government officials. This strategy, unfortunately, resulted in a brain drain, budget cuts at governmental bodies, and drastically curtailed expenditure on infrastructure.

Crucial Metrics in the Nearshoring Conversation

A suitable way to assess if nearshoring is truly occurring in Mexico is by examining the fluctuation in trade shares between the U.S., Mexico, and China. If enterprises exporting to the U.S. are indeed shifting from China to Mexico, we would expect a decline in China’s share and an increase in Mexico’s.

In the initial two months of 2023, Mexico surpassed China to become the U.S.’ leading trade partner, accounting for 15% as compared to China’s 14.2%. However, when we consider the change in trade shares from 2017, the notion of nearshoring seems less striking. Over this period, China’s share has dropped from 21.6% to 14.2%, while Mexico’s share only increased modestly from 13.4% to 15.0%, a mere 1.6%. Most of China’s lost share has been acquired by other Asian nations, notably Vietnam.

The story is somewhat more optimistic on a sectoral basis. For instance, the automotive sector, representing 32% of Mexico’s non-oil manufacturing exports to the U.S., experienced a robust 5.6% growth in its U.S. market share between 2017 and 2022. Other sectors competing with China, like iron and steel, also witnessed a 6.4% increase.

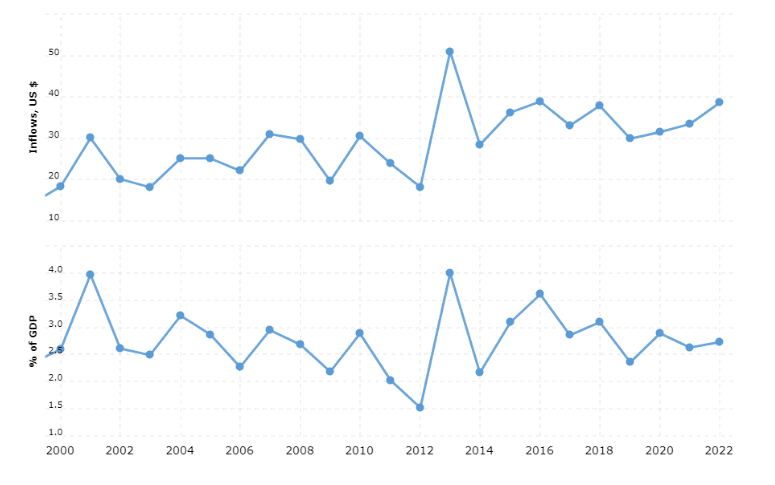

Another metric to consider is Foreign Direct Investment (FDI). If more foreign firms were establishing operations in Mexico, a surge in FDI would be expected. The FDI for 2022 was reported at 35.3 billion USD, of which 48% represented new investments, the highest level in a decade.

The 2022 FDI, when compared with the 2015-2017 period, does not appear notably high, and it’s significantly lower than the peak in 2013. Some of the FDI growth in 2022 is attributed to the Televisa-Univision merger and the restructuring of Aeromexico, both unrelated to nearshoring. When reviewing the trend of total manufacturing FDI, it doesn’t depict an enormous surge.

Mexico’s Future in Nearshoring

While Mexico has made substantial strides, its potential in nearshoring hinges on various factors. A report by The Economist’s Intelligence Unit highlights Mexico’s comparative weaknesses in terms of business environment, infrastructure, and technological readiness compared to Asian competitors.

Additionally, experts suggest that Mexico is still unequipped to gain a substantial market share in prominent sectors subject to the ongoing decoupling between the U.S. and China, including the semiconductor industry.

Currently, evidence of nearshoring occurring in Mexico remains minimal, but this could potentially shift in the forthcoming months or years.

The Inflation Reduction Act: A Catalyst for Change

Mexico’s inclusion in the US Inflation Reduction Act, aimed at attracting green industries to North America, could be a driving force behind nearshoring in the coming years.

In conclusion, Mexico’s ascent as a significant player in global trade signals a shift in the landscape of international commerce. While challenges and obstacles exist, Mexico’s geographic location, free trade agreement with the United States, and evolving trade dynamics position it as a formidable contender. The quest to replace China as a supplier of choice to the US is a race that many countries, including Mexico, India, Vietnam, Thailand, and Malaysia, are participating in. The future will reveal which nations emerge as the winners in this transformative journey.

As the world navigates the complexities of evolving trade relationships, Mexico stands at the crossroads of opportunity and challenge, ready to shape the future of global commerce.

- More from ResearchFDI: